Understanding Cost To Build vs. Appraised Value

Understanding Cost To Build vs. Appraised Value

The cost to design and build a home doesn't always match its appraised value.

Why does this happen, and what can you do about it? Let's break it down.

Why Do We Need Appraisals?

- Lenders require appraisals to assess a property's value concerning the market.

- Appraisers follow strict guidelines and compare the home with recent sales of similar properties.

Why the Disconnect?

- Appraised values can sometimes be lower than construction costs for new homes due to various factors like:

- Appraisals for new construction many not take into account the current cost of materials since appraisals are looking back at historical transactions. Even new homes recently sold may have been built with materials priced a year ago.

- Appraisers use both a cost approach and comparable approach to determining value, but the comparable approach is typically the value used for residential homes.

- Although there are strict guidelines, appraisers also have latitude in deciding which comparable properties to use and and the value (if any give) of upgrades in the custom home. Therefore, there is still subjectivity introduced into the process.

- Custom homes, built privately, may not serve as comparable sales (because the sale is not recorded).

- Narrow constraints on choice of comparable sales can make finding suitable matches difficult.

- Construction cost inflation can outpace market appreciation, leading to disparities.

Conversely, appraisals can also come in higher than the contracted price (but don’t worry…we won’t ask you to pay more if the appraisal comes in higher).

Something important to note: pre-approval from a lender DOES NOT equal appraisal. Just because you’ve been approved for an amount to spend, does not mean the home you are building will appraise for that value.

What Can You Do?

- As a custom home builder, we offer guidance but prioritize your dream home over matching appraised value.

- Be prepared to cover the cost-value gap if it exists.

- Plan with an awareness of appraised value and align specifications with market value.

- Consider making scope or cash compromises to meet your goals.

Key Questions To Ask Yourself:

- Will you prioritize a build + work scope close to appraised value?

- If your appraisal comes in low are you willing to:

- #1. Pay cash out of pocket for the difference,

OR

- #2. Change the work scope to align with appraisal?

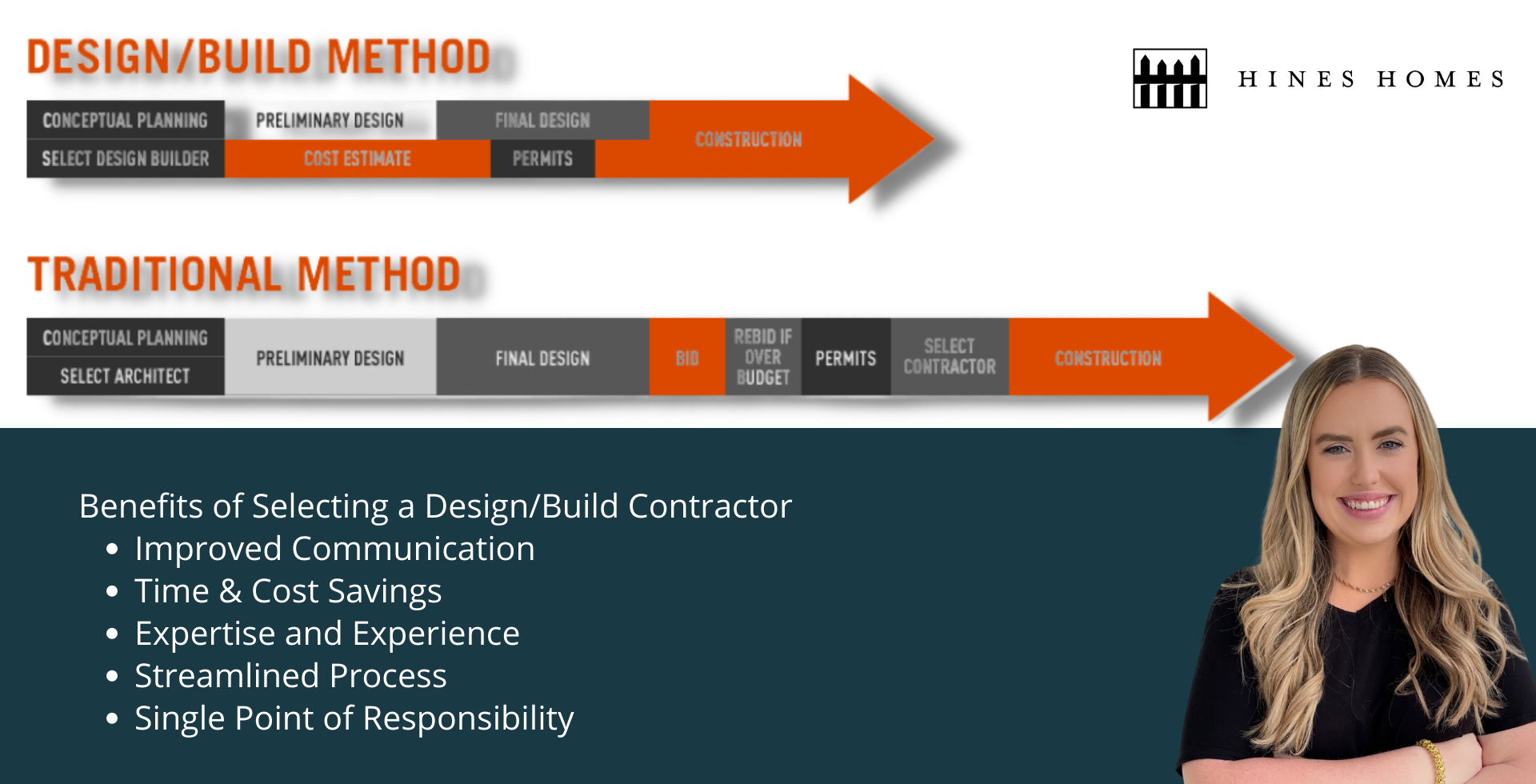

How Does Hines Homes Price Your Project?

In determining project costs for our clients, we assess the anticipated expenses of the project and apply a fair, standard markup to these costs. Our approach to pricing custom homes is rooted in

projected actual costs rather than relying on comparable sales. We take pride in assisting our clients in adhering to their budget, ensuring they can comfortably afford their dream home.

Your new home is a personal journey. While we offer guidance, the ultimate decisions lie in your hands. It's important to note that the appraised value might not align with the construction costs. In such instances, be prepared for potential challenges in securing financing.

Share